Driving Urban Operation Digitalization with AI

Empowering Financial-Business Integration with AI to Create a New Paradigm of Intelligent Finance,

driving urban operation digitalization with AI.

Annual labor savings from voucher automation

Automation rate of AI-generated vouchers

Business-finance integration

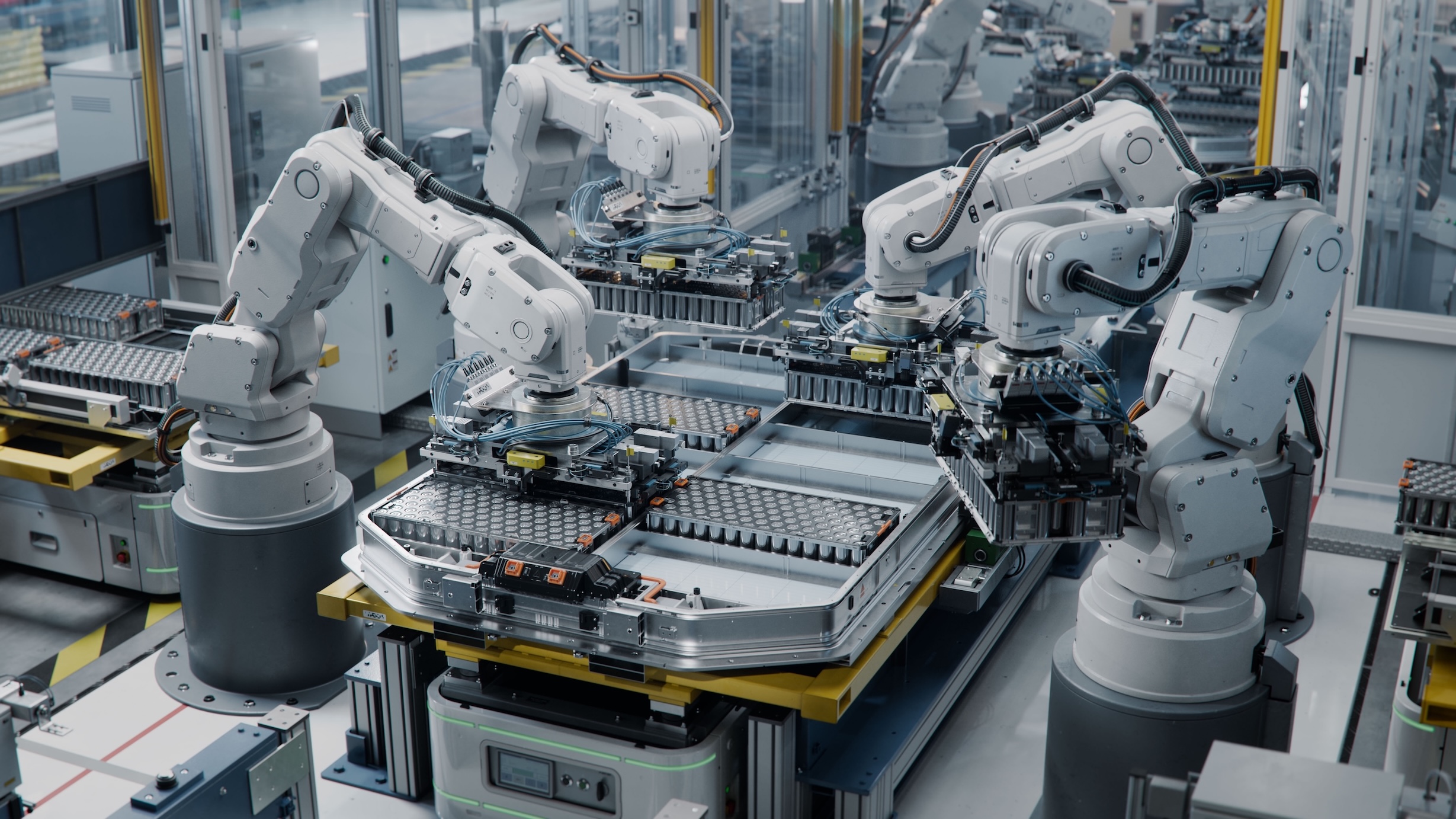

China Jinmao Holdings Group Limited (China Jinmao) is a leading enterprise in the field of urban operations under Sinochem Holdings and a regular fixture on the Fortune China 500 list. As an industry leader, China Jinmao was among the first to leverage AI technology in its digital transformation, making the leap from traditional management to intelligent operations through its integrated financial-business system.

Pain Points: Traditional Financial-Business Processes Require AI-Driven Transformation

Pain Points: Traditional Financial-Business Processes Require AI-Driven Transformation

During its rapid expansion, China Jinmao faces a range of core challenges that can be effectively addressed by AI-powered innovations:

- Low Manual Audit Efficiency: Repetitive tasks, such as travel expense reimbursements and voucher entry, consume significant time and are prone to human error.

- Insufficient Data Synergy: The data flow between business and financial systems relies on manual operation, affecting the timeliness of analysis.

- Lagging Risk Control: Traditional rule engines struggle to keep up with growing complexity, resulting in limited capabilities for detecting anomalies.

AI Solutions: Building an Intelligent “Trinity” Financial-Business System

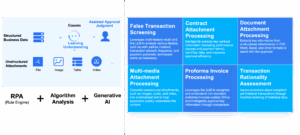

China Jinmao, in collaboration with Kingdee, takes the Kingdee Cloud – Sky AI platform as the core to achieve the following breakthrough applications:

1. Intelligent Audit and Automation

- OCR + RAG Technology: Automatically identify and extract data from unstructured documents, such as travel invoices and contracts, with over 95% accuracy.

- AI-Generated Vouchers: Use Natural Language Processing (NLP) to analyze business documents and enable up to 90% automation of voucher processing, saving 1,400 man-days per year.

2. Budget and Risk Intelligent Control

- AI – Based Budget Comparison: Monitor budget execution in real-time, automatically mark deviations and analyze the root causes, increasing management response speed by 40%.

- Intelligent Risk Early Warning: Combine algorithm models to detect abnormal transactions, such as duplicate reimbursements and excess expenses, with a 100% risk identification coverage rate.

3. Intelligent Reporting and Decision – Making Support

- AI – Driven Consolidated Financial Statements: Automatically consolidate data from multiple systems, increasing the efficiency of financial statement generation by 95% while ensuring data consistency.

- Automated Tax Compliance: Leverage rule engines and AI verification to achieve 100% accuracy in tax filings.

EN

EN